Development Charges Background Study and By-law Update

What are Development Charges?

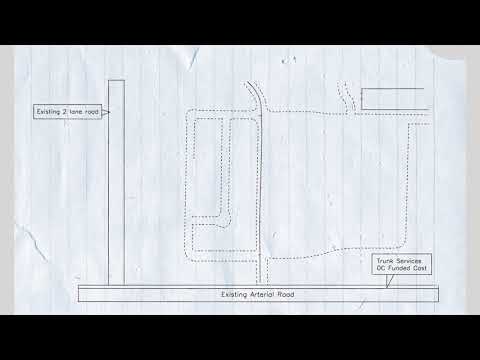

Development charges (DCs) are imposed by municipalities on developers or landowners to pay for increased capital costs related to growth. Growth related capital costs are costs that result from the expansion of services, like roads, water and wastewater services, police, fire and transit, to meet the needs of new development.

The principle behind development charges is that development pays for the share of capital costs associated with new growth and development while taxpayers or ratepayers fund infrastructure that benefits the existing population.

When is a Development Charge Payable?

A development charge is payable on the date a building permit is issued and is based on the development charge schedule in force on that date.

Why are the Background Study and By-law Being Updated?

The City of Greater Sudbury’s current by-law expires on June 30, 2024. The DC Background Study and new by-law must be approved before then in order to collect DC’s after June 30, 2024. The Background Study will illustrate the City’s existing service levels, the growth-related capital program, and the calculated development charges rate. Council will approve the development charges rate, which can’t exceed the calculated development charges rate determined by the Background Study. The by-law will establish the framework for application of the development charge and the rates that will be applied based on the type of development.

View the 2024 Development Charges Background Study here.

Draft Development Charges By-Law - April 30, 2024

2024 Development Charges By-law Proposed Changes

Public Meeting

A public meeting regarding the Development Charges Background Study will be held Tuesday, May 14, 2024 at 6 p.m. in Council Chamber. During the meeting, residents and stakeholders will have the opportunity to comment on the proposed development charge rates and policies.